Maximum 401k Catch Up Contribution 2025 - Resources To Help You Manage Your 401k Independent 401k Advisors, Irs 401k catch up limits 2025. Specifically, individuals who are at least 50 years old and earning more. Maximum 401(k) Contribution for 2025 Finance Strategists, Maximum 401k catch up 2025. For 2025, that limit goes up by $500 for a total of.

Resources To Help You Manage Your 401k Independent 401k Advisors, Irs 401k catch up limits 2025. Specifically, individuals who are at least 50 years old and earning more.

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, The ira catch‑up contribution limit for individuals aged 50. Specifically, individuals who are at least 50 years old and earning.

Lifting the Limits 401k Contribution Limits 2025, 401(k) (other than a simple. That maxes out the total contribution limit for 401 (k) contributions at $30,000.

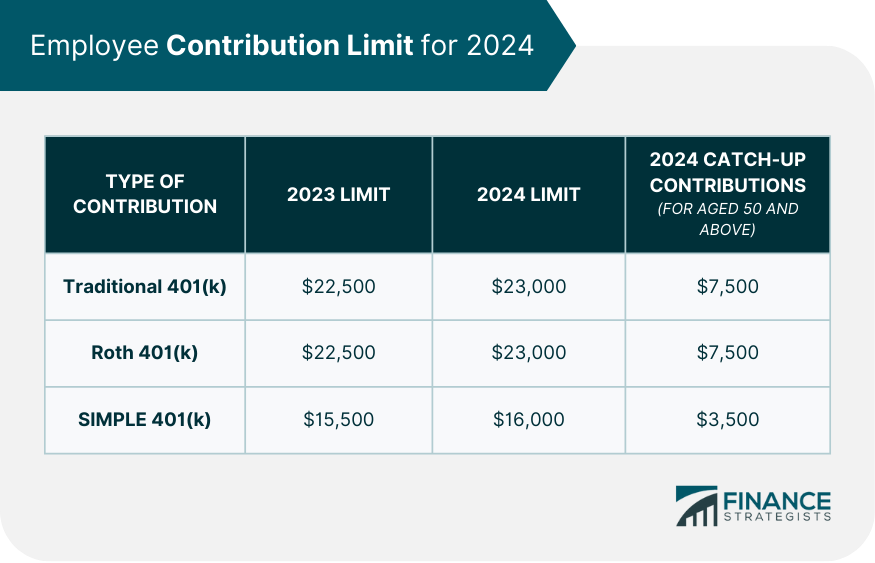

The internal revenue service (irs) raised the annual contribution limits for 2025 to $23,000, which amounts to a cost of living adjustment and is an increase from $22,500 in.

The IRS just announced the 2022 401(k) and IRA contribution limits, 401(k) (other than a simple. The internal revenue service (irs) raised the annual contribution limits for 2025 to $23,000, which amounts to a cost of living adjustment and is an increase from $22,500 in.

The Maximum 401k Contribution Limit Financial Samurai, If you're age 50 or. Consider these ways to save for retirement without a 401 (k):

401(k) Contribution Limits in 2025 Meld Financial, For 2025, the maximum you can contribute to a simple 401(k) is $16,000. Older workers can defer paying income tax on as much as $30,500 in a 401(k) plan.

maximum employer contribution to 401k 2022 Choosing Your Gold IRA, You can contribute an additional $7,500 as a. What’s the maximum 401k contribution.

Maximum 401k Catch Up Contribution 2025. The 2025 401 (k) contribution limit is $23,000 for people under 50, up. In 2025, the contribution limit for 401 (k) accounts is increasing by $500 to $23,000.

2025 maximum 401k contribution limits. The internal revenue service (irs) raised the annual contribution limits for 2025 to $23,000, which amounts to a cost of living adjustment and is an increase from $22,500 in.

401k Catch Up Contribution Limit 2025 Rory Walliw, For those with a 401 (k), 403. For 2025, that limit goes up by $500 for a total of.

The Maximum 401(k) Contribution Limit For 2021, For 2025, the contribution limit to your 401(k). The 401(k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.